CFDs, or Contracts for Difference, have become a popular way of trading. Instead of buying an actual asset, you simply speculate on its price movements. CFD traders can go both long and short, earning profits from both markets.

But, here’s the catch: You can’t trade CFDs on your own. This is where CFD brokers come in! They are your gateways to the market. CFD brokers give you the trading platform, tools, and leverage to speculate. Follow this guide to choose the best CFD trading broker:

Start With Regulation and Safety

Before you get tempted by the flashy ads of tighter spreads and low commissions, make sure the broker follows legal regulations. A regulated CFD broker is licensed by a recognised financial authority.

For instance, in Australia, the regulatory body is the Australian Securities and Investments Commission (ASIC). Licensed brokers make sure your funds are kept in separate accounts, while ensuring transparent trading conditions.

On the flip side, trading with an unregulated broker is super dangerous. Your money won’t be safe, as there are high chances of legal troubles.

Look at the Range of Assets

CFD trading is known for its flexibility, so it’s reasonable to work with a broker who actually facilitates a wide range of assets. We’re talking CFDs of:

- Forex

- Stocks

- Shares

- Indices

- Commodities

- Cryptocurrencies

In addition, make sure the broker facilitates price speculation on award-winning trading platforms. MetaTrader 5 is an excellent example of a good CFD trading platform. It is easy to navigate, has an intuitive interface, and facilitates multi-asset trading.

Advanced Trading Features

CFD trading brokers do more than just give you access to a trading platform. They provide additional features, such as:

- One-click execution

- In-depth market analysis

- Real-time alerts

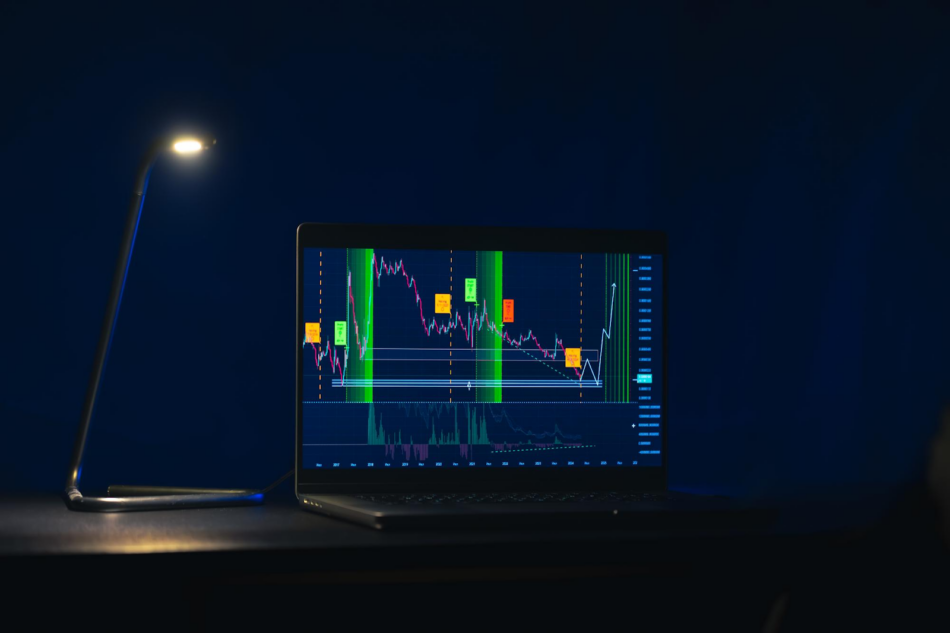

- Cutting-edge charting tools

Having a robust trading tool kit will give you confidence and help prepare you for uncertain market conditions.

Consider Reputation and Reviews

This can’t be emphasised enough. A broker offering exceptionally low commission fees isn’t necessarily the best option out there. Always check the industry reputation and reviews of a broker.

Dig deep into their website and read reviews. Check independent financial websites or review platforms to get unbiased opinions.

You’re choosing a trading partner, so a little research can go a long way.

Test the Trading Platform

Want to make sure you’re making the right choice before sealing the deal? Look for CFD brokers that offer demo accounts. For a couple of days, you can trade risk-free using virtual funds.

The benefit? A deeper understanding of the CFD trading world and a massive confidence boost.

You can try out different strategies and see what works and what doesn’t. A good demo account mirrors live market conditions as closely as possible.

Assess Customer Support

This is where a lot of CFD traders go wrong. They get satisfied with the features of a broker, but overlook future planning. What will happen when you run into a problem?

Reliable CFD brokers don’t leave you halfway. They provide 24/7 customer support via chat, phone, and email to answer your queries. An interrupted trading experience awaits!